After briefly raising the spectre of a threat of renewed recession this past spring, Professor Brian Long of the Grand Valley University Institute for Supply Management is signaling “a modest upturn” for the West Michigan economy, based on information he has garnered from his monthly survey of industrial leaders across the region. In fact, his opening statement sums it up: “Back on track.”

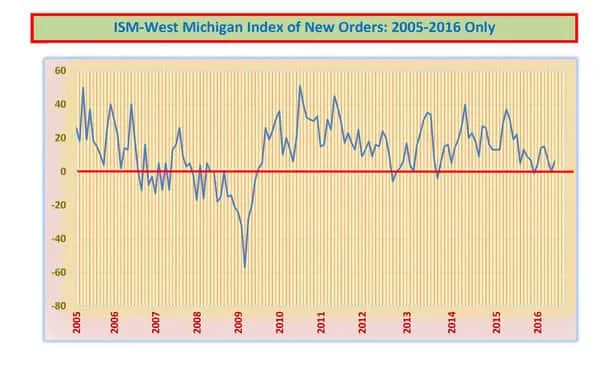

Long, who is Director of Supply Chain Management Research at GVSU, issues an assessment based on the latest data and anecdotal comments collected over the last two weeks of June. His New Orders Index…the index of overall business improvement…rose modestly to a reading of +6 from flat +0 a month earlier. In a similar move the important Production Index advanced to +11 up from +4 in May. Counter-balancing that data, the Purchasing Index edged to a negative reading of -1 from the previous reading of +7.

The Inventory Index, which represents both Finished Goods and Raw Materials, continued to show inventory accumulations well above normal, and Long says, “The anecdotal comments from the survey participants indicate that many firms are still concerned about the economic situation over the next year or so, but are continuing to move forward all the same.”

In his cover letter accompanying his annual research document, Long says “the slight softness that we observed last month has not morphed into a downturn, and may have been the result of a few seasonal factors that popped up in May.” He goes on to contend that , “In short, form the standpoint of our survey, there is no evidence that we are about to slide into a recession, even though there are plenty of anecdotal signals that project a possible end to the current (although anemic) expansion.”

When Long turns to specific industrial groups based in West Michigan, he points to a “stable” base for the office furniture business for the larger establishments, even as business “appears to be especially good” for a couple of the smaller firms.

West Michigan manufacturers engaged in the supply of auto parts “are still doing well,” according to Long’s report, however “with U.S. auto sales only up 1.4-percent for the first seven months of the year, there is a sense that the market is now starting to top out.”

Long says that, like most summer months, June sales for industrial distributors came in “mixed.” He cites, “excess equipment being dumped on the world markets,” resulting in “capital equipment firms continuing to report widely mixed results.” He sums it up by noting that standard types of equipment are available in abundance, while some of the specialty tooling is in short supply.

Looking ahead, Long’s report indicates “Despite some guarded optimism resonating from this month’s statistics, the business sentiment numbers from our local survey remain little changed.” Long’s Short Term Business Outlook, the forward looking forecast for the next three to six months “edged higher to +26 from +24.” Meanwhile, the Long Term Business Outlook for June, depicting the outlook for the next 3 to 5 years “eased modestly” to +35 from +42.

Before sharing anecdotal comments from survey participants and the accompanying charts and graphs, Long sums up the current state of affairs by saying, “It is true that our country has experienced some form of a recession every seven years or so for the past hundred years. Statistically, we are over seven years into the current recovery, and we are statistically and anecdotally ‘due.’ But, from an economic standpoint, there is still no evidence that we are about to enter an economic downturn. In fact, our local and national PMI numbers for June indicate a modest improvement in several critical areas. However, it is also noteworthy that many countries around the world have slid into recessions, and no countries are boasting an especially strong economy. The possibility of a relatively flat worldwide economy looks increasingly possible.”

As is Long’s standard practice, verbatim anecdotal comments, often times even more telling than the simply data points, are shared in order to give a more complete peek behind the curtain. Here are some of comments shared in Long’s June 2016 report:

- “Business has picked up slightly, but it’s still down from last year. We do have new programs coming on board during the fourth quarter.”

- “We have more work to do than we have people to do it!”

- “Things seem to be slowing down in automotive.”

- “We are starting to see some softening in orders which is typical this time of year in the auto industry.”

- “Orders are steady, and the outlook is good for 2017.”

- “Business is still relatively stable.”

- “Sales are down, resulting in a slippage in our shipments. We are looking for an uptick soon.”

- “Our sales increases are due to seasonality.”

- “Business is steady and strong. It’s been a good year so far.”

- “We had to scale back our workforce by 7-percent due to decreased activity level and the need to preserve cash.”

- “Business has been very strong in 2016 for automotive.”

- “Business is still a little slow.”

- “We are busy, and very steady.”

- “We are very busy quoting new business, and just purchased more machines for delivery in November.”

- “We are seeing continued normal, steady growth.”

- “We are working seven days a week and still can’t keep up with the automotive demand.”

- “Many new jobs being awarded. We are making large capital investments for business in 2017 and 2018.”

You can see Long’s full report for June 2016 by clicking the link below: