Tuesday is Valentine’s Day, but the end of the big holiday season at the end of the year also marked the end of a bit of a downturn in the West Michigan industrial economy, and now the region is moving into the back-to-work mode of 2017. That’s the thumbnail assessment of Dr. Brian Long, Director of Supply Chain Management Research at Grand Valley State University.

Long’s monthly survey proves that January’s standard role as a back to work month was no exception this year. Long says “For most of the recovery from the Great Recession, West Michigan outpaced the rest of the nation. Going forward, this is probably not going to be the case.” He adds, “I’m expecting a lot of our reports for the coming months to be less robust. In recent months, we have often reported that West Michigan was doing better than the rest of the state, and even the rest of the country. For this month, the opposite seems to be true.”

Long pins the reasoning for that on two of our most cyclical industries, namely automotive and office furniture. He tells us, “Both of these industries appear to have topped out, at least for the time being. For many months we have talked about saturation for the auto market, and that event has now arrived.” He suggests, “At best, the auto industry can hope to maintain the current level of sales for 2017. More than likely, the U.S. dealers will sell somewhat fewer cars in 2017 than in 2016. The margin will, or course, depend on the rest of the economy, which how appears to be gaining strength going into the first quarter of 2017.”

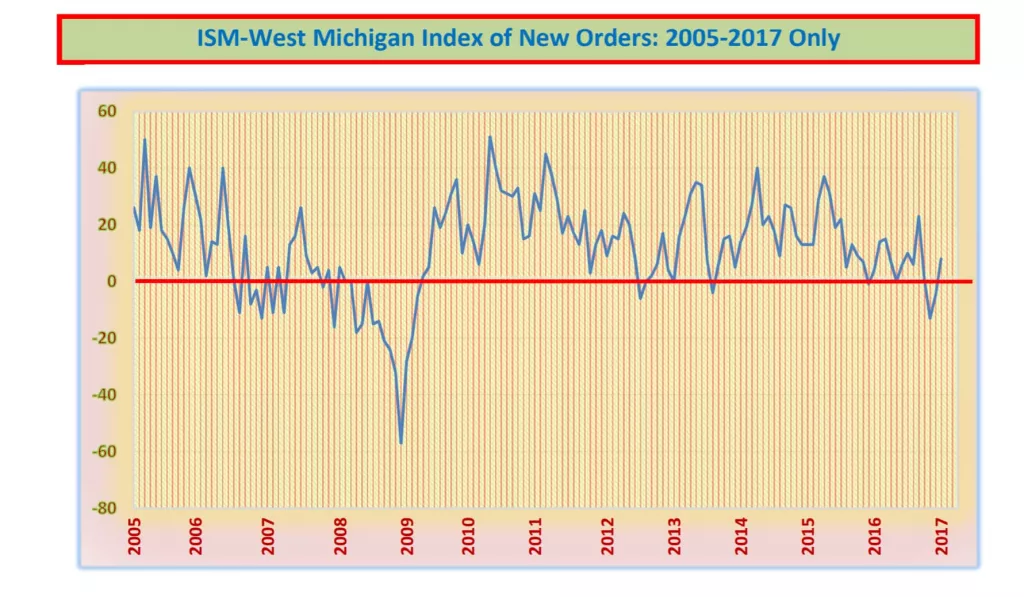

According to Long’s latest survey, conducted during the last two weeks of January, the New Order Index, his measure of business improvement, returned to a normal pace of +8, up nicely from December’s -5. He adds that most other key indices were also modestly positive.

The Production Index edged up to +8 from +3 the previous month. Activity in the purchasing offices as reflected in the Purchasing Index matched that performance, creeping up to +8 from December’s +3. The Finished Goods Inventories Index came back to break-even at +0, however the fear of more price increases drove the Raw Materials Inventories Index to rise to +11 from a +4 reading the month prior.

Long says, “Much as we suspected, the January numbers reflect the mood of the New Year,” however, “Many of our industrial groups are showing signs of topping out, so growth for the first quarter in West Michigan will probably be just modestly positive.”

When Long turns his attention to individual industrial sectors, the Auto Parts Suppliers continue to raise concern over the recent softening in auto sales, but remain positive about the 2017 outlook. For the Office Furniture Sector, most signs point toward sales topping out. Also, typical of past years, the January trend for the capital equipment manufacturing sector was modestly positive. Meanwhile, the performance for industrial distributors was also modestly better than December.

Finally, Long’s survey has a few firms that are tied in to the residential housing industry, and the strong housing market has fueled some significant growth for the Tier 1 and II suppliers that survived the housing crisis.

Long calls “gratifying” the business sentiment numbers for January, which continue to improve. The Short Term Business Outlook (the next 3 to 6 months) rose to +28 from +20, while the Long Term Business Outlook edged marginally higher to +47 from +45 in December.

Long closes out his January report by saying, “In summary, the current economic momentum is positive, which means that there is no recession on the horizon,” adding, “Based on the current positive momentum, the overall economy should remain solid for the next few months.”

Here are verbatim anecdotal comments culled from Long’s monthly survey of supply chain managers in West Michigan:

- “The January thaw is here, and we are over the Holiday hump! The inquiries are back, and orders are up!”

- “We continue to prosper & thrive in the capital equipment industry.”

- “We had a record December, but slow start to January. We are hoping to see some larger projects finally kick loose.”

- “Sales are still strong, and capacity is more in line over the past month than it has been. The flat to slightly down sales have allowed us to align capacity.”

- “Business is good now. We really think this will be a great year, but we think there could be some rough times ahead in the next few years.”

- “Business looks strong for the first few months of 2017.”

- “We had a lower outlook for the New Year during the fourth quarter, but 2017 has started very strong.”

- “Orders are starting to pick up. We are looking forward to a great 2017.”

- “It’s pretty stable month in regards to all issues. I believe we are seeing a post-holiday lull.”