The West Michigan Industrial Economy continued to grind out double digit growth in the month of March, and it isn’t getting any easier finding the people necessary to sustain that growth for the companies who need help the most. That’s the essence of Dr. Brian Long’s latest snapshot of the local scene as compiled in his March report being shared in industry circles.

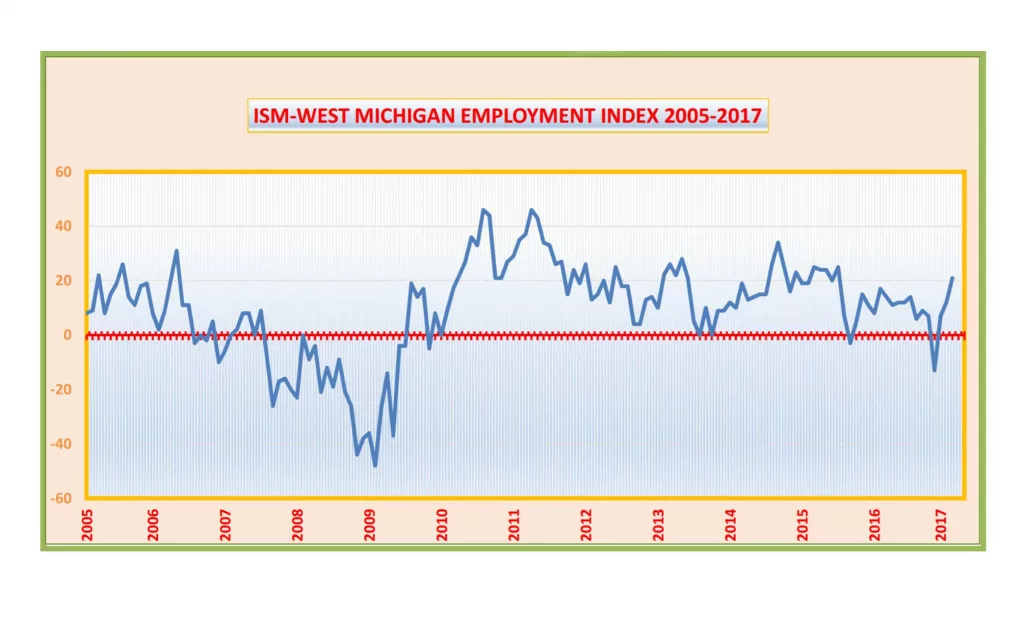

Dr. Long, who is Director of Supply Chain Management Research at Grand Valley State University in Grand Rapids, says, “Despite the signs that several local industries are topping out, West Michigan business conditions remain positive.” Long’s monthly research looks at a whole host of metrics including a gauge of employment, where he tells us despite the presidential campaign being long over, “We still hear the call for more jobs.” He says the mantra has been Jobs, Jobs, Jobs even though the campaign ended months ago. He notes, “About 85-percent of all jobs come from the private sector, so it was good to see our Employment Index for West Michigan edge up to a two-year high of +21.” He adds, however, “It is worth repeating that many industrial firms are still struggling to find new workers who are both qualified and dependable.”

Long’s monthly survey turned out a New Orders Index reading on business improvement moderating to +21, down slightly from +25 in February, however, the Production Index bounced significantly to +31 from a reading of +17 just one month earlier.

Activity in the Purchasing Index saw the marker jump to +25, up from +19 in February. Long adds, “Probably because of the strong sales reports, the March index representing Finished Goods Inventories dropped from +5 to -9, while the Production Index strength apparently caused some firms to drive up the Raw Materials Inventories Index down to +9 from +21 in February. He notes, however, that some firms are continuing to build inventory in fear of higher prices down the line.

Long contends that overall, the first quarter of 2017 in West Michigan has ended on a strong note, with “no sign of backing down.”

When Professor Long turns his spotlight on to individual industries he finds that some auto parts suppliers are still concerned about softening auto sales, “However, those firms supplying light truck and SUV components remain much more optimistic, as do firms who are successfully selling to the numerous transplant manufacturers around the world.”

With about 14-percent of the world’s office furniture made right here in West Michigan, Long reports “The spring season is opening on a positive footing for most firms, as well as their Tier 1 suppliers.” He also reports that the capital equipment rally that began in January may have run its course, although some firms are still positive. He reports that the industrial distribution market is logging mixed results.

With the recent pattern of economic improvement on the upturn, Long says the market has been able to maintain a positive outlook for the Economic Outlook. For March, the Short Term Business Outlook, which asks local firms about the perceptions over the next three to six months, registered a small uptick from +37 to +39. However, when looking out at the coming three to five years, the Long Term Business Outlook retreated modestly to +42 from +47 in February. The Professor also notes, “Although a few respondents are somewhat pessimistic, most of the comments for March remain optimistic.

Long does voice a bit of concern regarding inflation, saying “One major threat to the profitability of our local industrial firms continues to be industrial inflation. After moderating last month, our local Price Index jumped to +39 from +27.” He adds that for the first time in more than six years, not a single firm reported a significant level of falling prices.

Because of the year-over-year sales drop in light vehicle sales for March, West Michigan automotive parts suppliers continue to be cautious.

In wrapping up his report, Professor Long poses the hypothetical, “Where do we go from here?” He says, “Clearly, most of our state, local and national statistics continue to improve, but the Trump Rally, which has driven the stock market about 17-percent higher since Election Day, may have run its course.” He concludes, “For the Trump Rally to continue, we need to see some kind of progress (on election promises) fairly soon.”

As always, Dr. Long’s report includes verbatim anecdotal comments from participants in the survey. Here is a sampling of those comments, share verbatim once again:

- “2017 sales will probably be very similar to last year.”

- “February was slow, almost painfully slow. Looks like March is a little better, but activity is still below where I would like to see it.”

- “Price increases abound!”

- “We are very busy and are still working hard to find people and automate.”

- “Business is starting to ramp up.”

- “Softening in business jet sales coupled with some new aircraft delays are resulting in reduced sales forecast and need for small layoff.”

- “Attrition is taking place, and there is no sense of urgency to backfill.”

- “Orders have dropped a small amount. We still have confidence for a good year, just maybe not as good as 2016!”

- “The summer is looking busy.”

- “I’m not sure why capital equipment is no a downturn. Maybe it is because of uncertainty in the new trade policies. My guess is that our customers are not sure which part of the world will be the most economical for placing new equipment orders.”

- “Scrap prices continue to escalate. Business is very strong for the next few months.”