Calling it a “significant bounce” in February, the man who keeps close tabs on the West Michigan Industrial Economy by tracking multiple index measures through a monthly survey process says, “January was good, but February was better.”

Dr. Brian Long, Director of Supply Chain Management Research at Grand Valley State University, calls the February data a “significant bounce,” but in a sidebar commentary cautions that soaring trade deficits in America over the past 28 years could be dramatically exacerbated by the President’s proposed 25-percent tariff on steel thanks to potential retaliatory responses in a trade war.

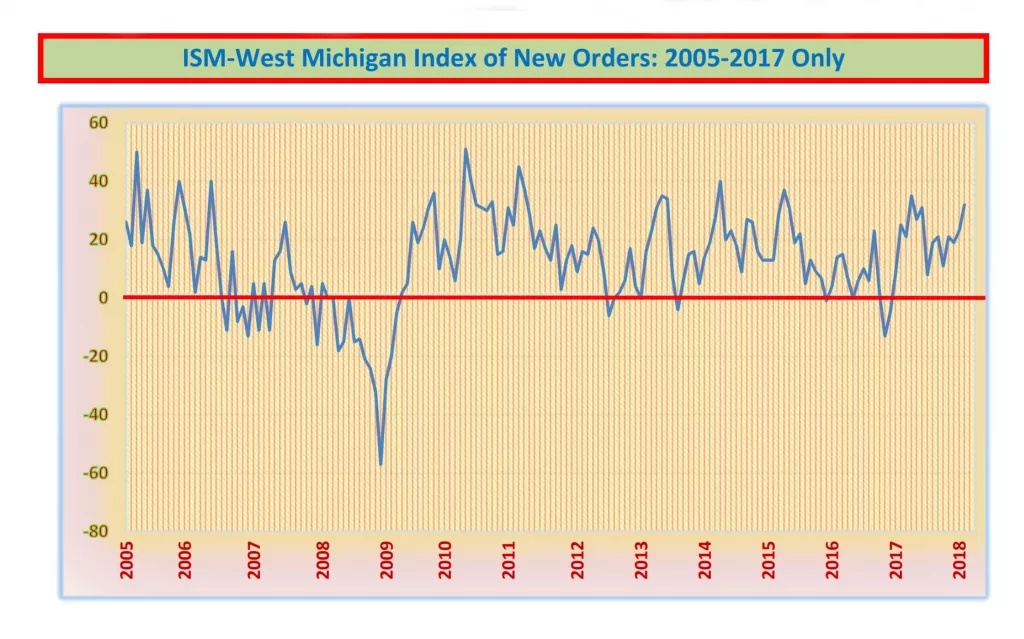

For the moment, however, the professor is pointing to his data collection over the last two weeks of February when his closely-watched New Order Index spiked from +23 to +32 in a single month. He adds, in a similar move the West Michigan Industrial Production Index edged up to +31 from the preceding month’s +24.

Dr. Long points to a more modest move in his Purchasing Index wh rose modestly to +22 from +18 in the first month of the new year. Long says, “Although the West Michigan Industrial Economy has been in a pattern of slow growth for the past eight years, we still get an occasional bounce like we did in February. We will see if the trend continues in the coming months.”

Long suggests that the positive result of the recent tax reform legislation has been a boon to the capital equipment manufacturers. He says, “Although there are a few exceptions, most of these firms report being recently swamped with new orders.” Looking at individual sectors, Long says slower auto sales remain a concern to the automotive parts producers, “But most remain stable, and a few which are actually still growing.” He notes that the same is true of the office furniture manufacturers in the region, noting, “Most are topping out, but a couple of the smaller firms are expanding.”

Long tells us that with the exception of one local survey participant, February “was a great month for the industrial distributors who participate” in his monthly survey, but he also notes, “Regrettably, almost all of the manufacturing firms continue to be constrained by an inability to find new workers to fill open positions.”

When looking at the unemployment numbers, Professor Long says, “Although the Michigan unemployment rate for people ‘actively looking for work’ has improved modestly in recent months, the latest numbers reported by Michigan’s Department of Technology, Management & Budget came in at 4.7-percent, somewhat higher than the official national rate of 4.1-percent.” He adds, “Michigan’s U-6 rate, which includes part-time and discouraged job seekers, has now fallen to 9.1-percent. Looking at individual city and county unemployment rates, some people have become concerned that the rates are now as much as a half percentage point higher than last year at the same time. Hence, it is worth repeating that these slightly higher rates stem from workers reentering the workforce and ‘actively looking for work.’”

Professor Long’s never-ending peek into the future got a nice uptick in company forecasting circles as he tells us, “The ambiance of the industrial economy received a significant boost in February, probably because of the recent tax cuts and otherwise positive economic news. The February West Michigan index for the Short Term Business Outlook, which asks local firms about the perception for the next three to six months, jumped to +51 from +38, a record high. The Long Term Business Outlook also posted a significant bounce and rose to +53 from +44. However, these statistics were gathered before the tariff announcement, which implies that this month’s gains could become next month’s losses.”

As is the researcher’s habit, he shares verbatim anecdotal comments from a number of survey respondents and we share some of those with you here, as well:

- “Carbide steel pricing is going up, forcing tooling suppliers to raise pricing.”

- “We’re starting to see some projects cut loose. Finally!”

- “Price increases seem to be announced daily.”

- “Business is steady and strong.”

- “Business is steady, but not increasing at this time.”

- “Business is good. We had a slight downturn at the beginning of January but it was short lived.”

- “We are a little slower in February, but March forecast looks strong.”

- “Lead times and prices for passive components are increasing reportedly all the way into 2019.”

- “Tightening belt on employment showing some negative impacts to FG levels.”

- “This is our normal slow time of year. Business is steady and looks to be picking up next month.”

- “We are running out of stock on many items and are looking to add suppliers to keep up with the demand.”

- “Business is strong and expenses are controlled. Controlled growth is extremely important to ensure profitability while continuing to grow top-line sales.”

- “We opened 2018 with record sales.”

- “What the heck happened? VERY slow. Dec was worst month of the year. January was barely better. February is awful. All the customers and vendors we are talking to are saying business is way off.”

Here is a link to Dr. Long’s complete report: