The latest Comerica Bank Economic Outlook for Michigan contends that U.S. auto sales “likely peaked for this business cycle last fall,” and as a result delivers a forecast for slower sales at an annualized rate of 17.2-million units — a fall-off from last fall’s record-setting production rate of 18.1-million units.

The forecast is part of a “Steady Michigan” forecast from Comerica’s Chief Economist Robert Dye and his colleagues released this week. He attributes the resurgent auto industry for the steady growth story in Michigan, pointing to an up tick in employment in July to 604,200 in the manufacturing sector alone.

Nevertheless, in looking at the last four business cycles, which he roughly categorizes as the 70s, 80s, 90s and 2000s, he assumes auto sales will follow “the middle path,” and essentially “forecasting a moderate deterioration of auto sales into 2018.” Additionally, and “regardless of the eventual downward slope,” Dye says Comerica’s assumptions are “consistent with eventual job losses in manufacturing,” throughout the state. On the upside, they look for gains in service-sector jobs to keep Michigan’s expansion “steady through 2017.”

The economic outlook forecasts continued improvement in the state’s gross domestic state product, but at a slower rate from the antcipated 2.5-percent growth expected by year’s end to a 2.2-percent increase forecast in the year ahead.

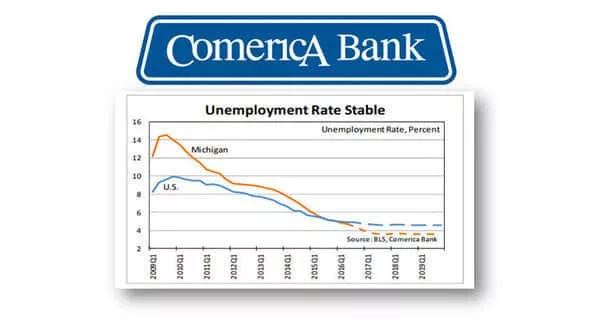

The Comerica forecast pegs total payroll jobs in Michigan rising from 4,324,000 jobs at the end of the second quarter this year to 4,420,000 by the end of 2017. As a result, Dye is projecting the state’s unemployment rate to continue to drop, going from 4.7-percent at the end of the second quarter to 4.4-percent in the third, and then down to 4.1-percent, 3.8-percent, 3.7-percent and 3.6-percent in the ensuing quarters by the end of next year.

You can see the full 2-page report from Comerica Bank by clicking the link below: