Thanks to their endless drive to assure the competitiveness of Michigan’s Great Southwest in the economic development arena, Cornerstone Alliance has succeeded in garnering critical new Opportunity Zone designation for three northern Berrien County areas which could attract new tax-advantaged investments to those areas.

Cornerstone Alliance President Rob Cleveland received word late yesterday from Brian Mills, Chief of Staff of the Michigan State Housing Development Authority that the U.S. Department of the Treasury and the Internal Revenue Service (IRS) had approved Gov. Rick Snyder’s Opportunity Zone nominations which include the three census tracts requested by Cornerstone. They are part of 288 tracts in 18 states designated Monday as Opportunity Zones. The Tax Cuts and Jobs Act created Opportunity Zones to spur investment in distressed communities throughout the country. New investments in Opportunity Zones can receive preferential tax treatment.

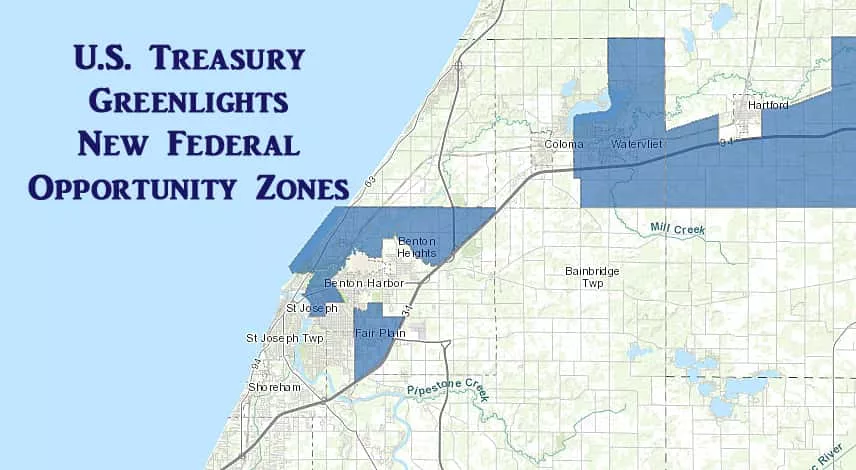

Cleveland says there was a strategy behind the three areas in Berrien County which include portions of several areas include parts of Fairplain, Benton Harbor, Benton Township, and eastern portions of the Paw Paw Lake area. All can be seen on the map depicted in the photo above. He says that Cornerstone Chief Operating Officer and Vice President for Business Development Greg Vaughn led the team’s effort and did great work on the matter.

Under the Tax Cuts and Jobs Act, States, D.C., and U.S. possessions nominate low-income communities to be designated as Qualified Opportunity Zones, which are eligible for the tax benefit. States were required by March 21st to submit nominations or request a 30 day extension to submit nominations. Treasury has 30 days from the date of submission to designate the nominated zones. Treasury has designated the nominations of all States that submitted by the March 21st deadline. They will make future designations as submissions by the states that have requested an extension are received and certified.

Greg Vaughn points out, “Cornerstone Alliance has long been a connector for public and private sector investments,” and adds, “Opportunity Zones present us with a new tool to promote our community to investors and companies seeking investment and growth opportunities.” The locally designated zones include the Orchards Mall, the Fairplain Plaza, the Cornerstone Industrial Park off North Crystal Avenue, the entire city of Watervliet and beyond, and multiple other census tracts.

U.S. Treasury Secretary Steven Mnuchin says, “I am very excited about the prospects for Opportunity Zones. Attracting needed private investment into these low-income communities will lead to their economic revitalization, and ensure economic growth is experienced throughout the nation.” Mnuchin adss, “The Administration will continue working with States and the private sector to encourage investment and development in Opportunity Zones and other economically disadvantaged areas and boost economic growth and job creation.”

In addition to sites in Michigan, submissions were approved Monday for: American Samoa; Arizona; California; Colorado; Georgia; Idaho; Kentucky; Mississippi; Nebraska; New Jersey; Oklahoma; Puerto Rico; South Carolina; South Dakota; Vermont; Virgin Islands; and Wisconsin.

Cornerstone’s Vaughn says, “We are pleased that the census tracts recommended by us have been designated by U.S. Treasury as official Opportunity Zones for the State of Michigan. In this highly competitive economic development environment, we are continually seeking and exploring options that draw investor attention and better position our community, in this case low-income areas, for job and economic growth opportunities.”

Qualified Opportunity Zones retain the designation for 10 years. Investors can defer tax on any prior gains until no later than December 31, 2026, so long as the gain is reinvested in a Qualified Opportunity Fund, an investment vehicle organized to make investments in Qualified Opportunity Zones. In addition, if the investor holds the investment in the Opportunity Fund for at least ten years, the investor would be eligible for an increase in its basis equal to the fair market value of the investment on the date that it is sold.

Treasury and the IRS plan to issue additional information on Qualified Opportunity Funds. The additional guidance will address the certification of Opportunity Funds, which are required to have at least 90-percent of fund assets invested in Opportunity Zones.

At MSHDA, Brian Mills says, “It is our understanding that this tax benefit can be combined with other incentives such as New Market Tax Credits, Low-Income Housing Tax Credit, and historic rehabilitation tax credit, adding a valuable tool for economic and community development.”