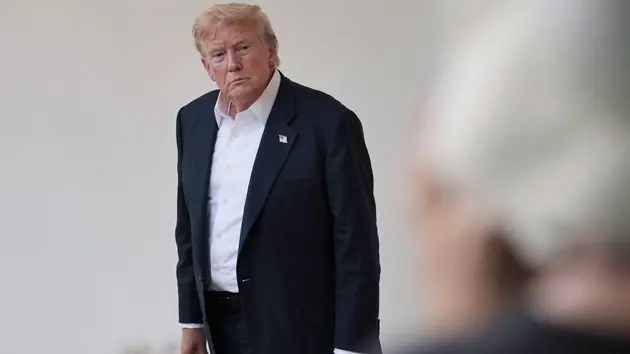

(NEW YORK) — Hiring slowed in July as President Donald Trump’s tariffs pinched the balance sheets of some major companies and reshaped the nation’s trade relationships. The reading fell short of economists’ expectations.

The U.S. added 73,000 jobs in July, according to data from the U.S. Bureau of Labor Statistics, or BLS. That figured marked a slowdown from 147,000 jobs added in the previous month. The unemployment rate ticked up to 4.2%, keeping it at near-historic lows.

The report also provided new estimates for two previous months, significantly dropping the government’s estimate of jobs added in May and June. In May, the U.S. added 19,000 jobs, much lower than a previously estimated total of 139,000 jobs, the BLS said. While in June, the economy added just 14,000 jobs, revising downward a previous estimate of 147,000 jobs.

The fresh jobs data indicated a notable slowdown in hiring as Trump’s tariffs took hold over recent months.

“Not only was this a much weaker than forecast payrolls number, the monster downward revisions to the past two months inflicts a major blow to the picture of labor market robustness,” Seema Shah, chief global strategist at Principal Asset Management, told ABC News in a statement.

The jobs report arrives days after a separate government report showed better-than-expected economic growth. U.S. GDP increased at a 3% annualized rate over three months ending in June, the report said.

The robust reading suggested the economy has continued to avert a significant tariff-induced cooldown. A one-off statistical quirk tied to a drop-off of imports appeared to partially account for the surge, however.

Some key measures of the economy have proven resilient in recent months, defying fears of resurgent inflation and a possible economic downturn. Inflation has increased for two consecutive months but it remains well below a peak attained in June 2022.

The hiring data arrives days after the Federal Reserve opted to hold interest rates steady at its July meeting.

Five meetings and seven months have elapsed since the Fed last adjusted interest rates. The federal funds rate stands between 4.25% and 4.5%, preserving much of a sharp increase imposed in response to a pandemic-era bout of inflation.

A meaningful slowdown in the labor market could prompt the Fed to grant greater consideration to a potential rate cut.

Trump has repeatedly urged the central bank to lower interest rates, saying the policy would boost economic performance and reduce interest payments on government debt.

Fed Chair Jerome Powell, by contrast, has voiced some concern about a rekindling of inflation due to elevated tariffs. Importers typically pass along a share of the higher tax burden in the form of price hikes.

Speaking at a press conference in Washington, D.C., on Wednesday, Powell said tariffs had begun to contribute to price increases for some goods but the ultimate impact of the policy remains uncertain.

“Higher tariffs have begun to show through more clearly into prices of some goods but their overall effects on inflation and the economy remain to be seen,” Powell said. “Their effects on inflation could prove to be short-lived, but it is possible the inflation effects could be more persistent.”

He added, “We’ll do what we need to do to keep inflation under control.”

Copyright © 2025, ABC Audio. All rights reserved.