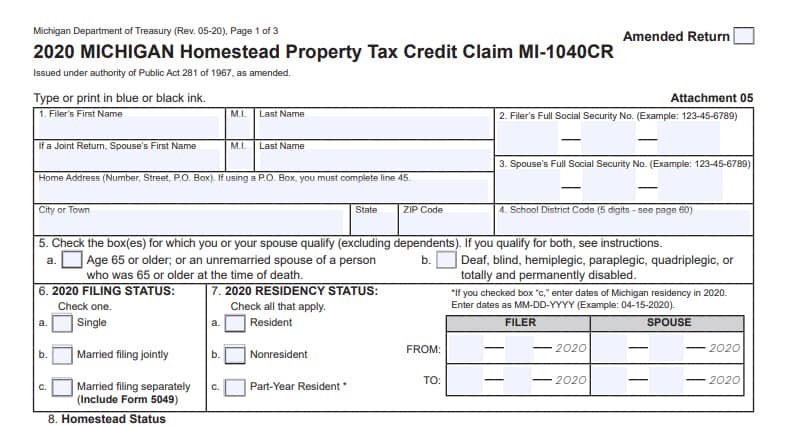

As you work to wrap up filing your taxes this year, the Michigan Department of Treasury is reminding many working families and individuals across the state that they may be eligible for a Homestead Property Tax Credit.

In fact, the average tax credit in Tax Year 2019 came to $669, so it’s well worth looking into.

Those working families and individuals with household resources of $60,000 or less a year may be eligible for the Homestead Property Tax Credit.

Michigan’s Homestead Property Tax Credit can help taxpayers if they are a qualified homeowner or renter and meet certain requirements. For most people, the tax credit is based on a comparison between property taxes and total household income, with homeowners paying property taxes directly and renters paying them indirectly with their rent.

Deputy State Treasurer Glenn White, head of Treasury’s Revenue Services programs, tells us, “Homestead Property Tax Credits provide tax relief for Michigan’s working families and individuals,” and adds, “These tax credits can reduce tax owed and may provide a refund.”

For the 2019 tax year, more than 1.1 million (or 1,172,000) taxpayers claimed the Homestead Property Tax Credit, totaling more than $784.8 million with an average credit at $669.

Here’s how to determine your eligibility. Taxpayers may claim a Homestead Property Tax Credit if ALL of the following apply:

- Your homestead is in Michigan

- You were a resident of Michigan for at least six months during the year

- You own or are contracted to pay rent and occupy a Michigan homestead on which property taxes were levied

- If you own your home, your taxable value is $135,000 or less (unless unoccupied farmland)

- Your Total Household Resources are $60,000 or less

Taxpayers who are required to file a state income tax return should claim the Homestead Property Tax Credit with their return. Taxpayers may also file a Homestead Property Tax Credit claim by itself.

Unemployment compensation – including the federal exclusion – is still included in a taxpayer’s Total Household Resources. Take note that while the federal American Rescue Plan Act reduced Adjusted Gross Income and state tax liabilities, it doesn’t reduce Total Household Resources.

To learn more about the Homestead Property Tax Credit and state income taxes, you can go to http://www.michigan.gov/incometax and click on “Credits and Exemptions” at the bottom of the page.