The man who watches the West Michigan industrial economy more closely than seemingly anyone else in the region has a very blunt assessment as a result of his latest monthly survey of market conditions, “From the standpoint of the West Michigan economy, we have now entered the worst economic conditions in the 40-year history of this survey.”

Dr. Brian Long, Director of Supply Management at Grand Valley State University in Grand Rapids says, “The data we collected in the last two weeks of March are now extremely outdated. We can expect that the data we collect in April will be extremely weak,” and asks, “Could the current situation get even worse?” He then answers his own question, saying, “Regrettably, yes,” while suggesting, “Keep an eye on the supply chains and the continued viability of e-commerce delivery. So far, the virus has not shut down Amazon, e-bay, and the UPS, USPS, and FedEx delivery systems. If the virus gets out of hand, this could be another shoe to drop. Ditto the home delivery now being offered by grocery stores and restaurants.”

Professor Long’s monthly survey opens with the comment, “In the forty-year history of this survey, the economic situation in West Michigan has seldom looked this grim.” By way of example, he says, “Although negative, much of our data collected in the third and fourth weeks of March do not begin to reflect the impact of recent events.”

Long’s New Orders Index slipped to -21 from +7, and his Production index eased to -16 from +2. He points out, “Unfortunately, both of these indices are now poised to set record lows when the data are posed for April.” His March Purchasing Index, which measures activity in the purchasing offices, plunged to -30 from +9. He suggests, “With many purchasing offices closed altogether, we can look for another record low in April.”

Professor Long, in a letter accompanying his survey, says, “The most recent CDC guidelines show that, contrary to previous mis-information, this virus can last for up to 5 days on metal, glass, ceramic and paper surfaces, and up to 2-3 days on plastic or stainless steel. Cardboard is now one day, but remember a plastic shipping label could still be contaminated 2-3 days later. If these numbers from CDC are correct, which they probably are, this virus is going to be one of the most communicable in history. Only a few days ago, reputable sources (including the Mayo clinic) were telling us that the virus would only live for about 12 hours on most hard surfaces. Again, this implies that many forms of home delivery are not necessarily safe. Failure to recognize the extreme contagious nature of the virus has been problem from the get-go.”

Turning to industrial inflation, Long says that for West Michigan, the March Price Index dropped to -18 from February’s +3. For the ISM national survey, the Price Index dropped more significantly to -37 from -8. At the international level, the JPM Price Index eased to 50.1 from 51.9. Long notes, “However, just like all of our other statistics, the readings reflect business conditions before the entire impact of the pandemic had hit.”

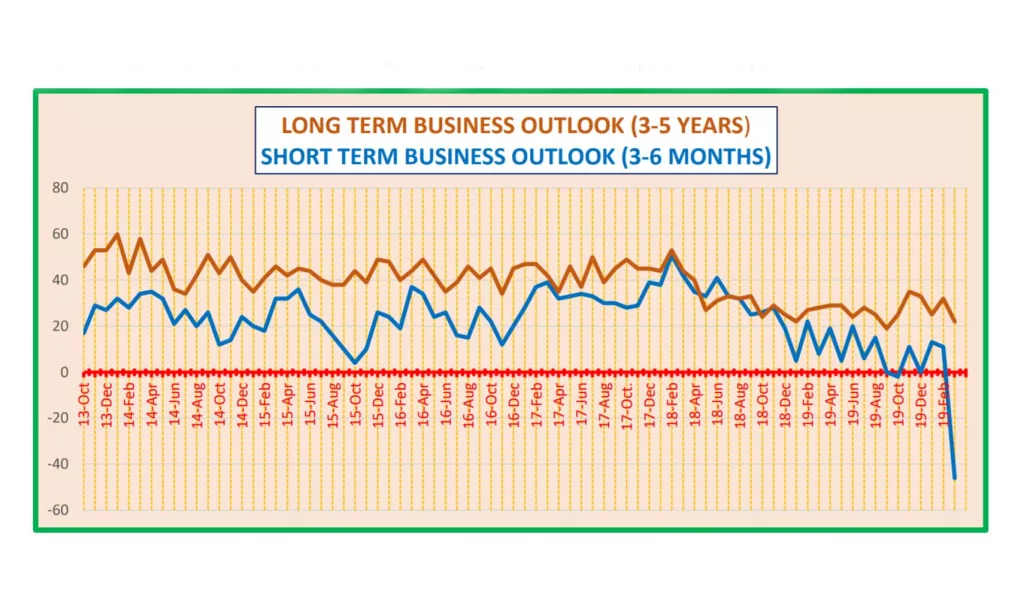

Moving to future forecasting by individual manufacturers, Long says,”It is hardly a surprise that West Michigan’s Short-Term Business Outlook for March, which asks local firms about the perception for the next three to six months, plunged to -46, down from +11. The April reading will probably be even worse.” He goes on to say, “The index for the Long-Term Business Outlook, which queries the perception for the next three to five years, remained positive but edged lower to +22 from +32. In a similar vein, CEIC Data Corporation’s monthly survey of U.S. Business confidence dropped 11 points to its lowest level in over ten years. The survey author also projected the next reading to be much worse.”

Dr. Long, who has been at this process for many years, concludes his report by saying, “At this early stage, assessing the economic impact of this pandemic is almost impossible, except to say that we are now in a historical collapse. If, by some miracle, we were to have a viable vaccine in the next few months that could be widely distributed, the economy would quickly begin to recover. However, some marginal businesses have already been forced to close, and there will surely be more to follow. Unfortunately, this crisis is still just beginning.”

From his accompanying letter, Long adds, “To repeat from last month, the formal definition of a recession is ‘two continuous quarters of negative economic growth as measured by GDP.’ Clearly, the second and third quarters of 2020 will be negative. There is no doubt that we are now in a recession.”

Diving deeper he notes, “There is now the dreaded ‘D’ word starting to float around, although there is no ‘formal’ definition of a depression. However, we can attach a few attributes in order to formulate one:

- Extremely negative economic growth lasting many months, not the traditional “V”…

- Extremely high unemployment in the range of 25% – 35% or even higher…

- Numerous businesses folding with no hope of recovery…

- Widespread despair…

Long asks, “Can we avoid a depression?” and answers, “Yes, it is still possible, but the current crisis has been triggered by a pandemic that is so far not abating.”

As is Professor Long’s standard procedure, he shares a number of anonymous, verbatim, anecdotal comments from survey participants to provide a feel for what people are saying across the West Michigan industrial economy. Here are some of those he shared this month:

- “It is a very weird time with this virus around.”

- “February was business as usual preparing for the 2020 construction season…. all to come to a drastic change in March.”

- “Sales are ok, today but an inevitable slowing is expected. The hope is it will be manageable and not a cliff drop.”

- “We expect a weak 3-6 months.”

- “We are steady at this point and have not seen any order cancellations, but we are not seeing a lot of new orders. We build capital equipment, so I would anticipate companies halting capital expenditures in the short term.”

- “Once in a lifetime (hopefully) global event.”

- “Still too early to know the extent of issues COVID will cause. Global teams all reporting the same thing: no issues yet, but changing soon.”

- “It’s getting rather spooky out there now.”

- “There is a great deal of uncertainty due to the unknown impact of the Corona Virus.”

- “Very slow. Everybody is using caution in their investment of capital equipment.”

- “Everything maintains the illusion of normal sales/parts going out the door. However, the question is when will the demand slow and for how long, based on Covid-19 issues.”

- “March is a busy month but April and May look slower. Will be interesting to see how the coronavirus situation impacts manufacturing.”

- “We are extremely busy trying to fill orders related to Covid-19.”

- “COVID 19 has only begun to wreak havoc.”

- “So far, the Covid-19 hasn’t had a negative impact on our business, but I believe it’s the calm before the storm.”

- “This Coronavirus is wreaking havoc all over the world. Times are uncertain. It’s scary right now.”

To see Dr. Long’s full report, click this link: gr-2020-4