There’s a new peak in the recovery of the West Michigan industrial economy as the region has “jumped into 2021 on a very positive note.” That’s the quick takeaway from the man who has the pulse of the region thanks to his role as Director of Supply Chain Management Research at Grand Valley State University.

Dr. Brian Long says that January’s snapshot is “typical of most recession recoveries,” in that “nearly all of our statistics responded to the pent-up demand created over these past months.” He notes, however, “Although most industrial firms have managed to get back to work, others have been permanently damaged by the pandemic. They don’t statistically show up until we settle into the new norm.”

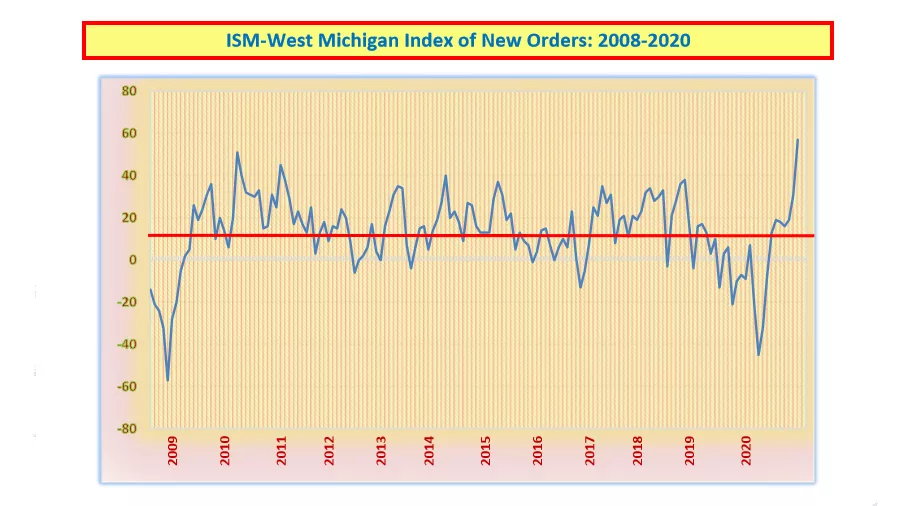

Long says that according to the data collected in the third and fourth weeks of January, his closely watched New Orders Index, which tracks overall business improvement, jumped to a peak of +57, up sharply from +31 in December.

Meanwhile, his Production Index, which is termed “output” by many economists, also bounced to +52, up from December’s +33, and up very sharply from November’s +2. Things were a bit more modest when surveying activity in regional purchasing offices although the numbers remained positive. Professor Long’s Purchasing Index rose at a more modest pace to +32 from +26.

Long says, “With temperature checks, social distancing, roaming disinfecting teams, and locked-down lunch rooms, most firms are still managing to function. Sporadic absenteeism and worker shortages for some firms present a challenge for management.”

An additional impact is being felt due to shortages of many commodities which are widespread, and January’s Lead Times Index came in at a record-setting +68, up from +64. Long suggests, “Although some people are now beginning to receive at least one dose of the vaccine, the entire business supply chain is still far from returning to normal.” Nevertheless, he reports, “The demand for many local products and services continues to rise, so many of our participant ‘comments’ are positive, although many supply chain professionals are definitely feeling the multidimensional stresses brought on by the pandemic.” The numbers guru says, “Again, this month’s spectacular statistics are the result of pent-up demand and should not be taken to mean we are entering a new wave of economic euphoria. Also, keep in mind that there are still many firms not sharing in the recovery.”

Turning his attention specifically to the automotive sector, Professor Long tells us, “West Michigan auto parts suppliers are undoubtedly pleased to see January auto sales for some firms coming in stronger than expected. However, a drop of 22-percent in fleet sales continued to hold the estimated Seasonally Adjusted Annual Rate for January at 16.4 million units, about 3.7-percent lower than last January.”

In the auto market, winners for the month included Hyundai-Kia, up 7.8-percent, Mazda gaining 6.9-percent, and both Toyota and Subaru edging up 0.2-percent. Losers for January included Ford, down 8.6-percent, and Honda down 9.4-percent, largely because of the firm’s slim lineup of light trucks and SUVs. Long says that GM and Chrysler are no longer reporting monthly sales, “but estimates for both firms were negative,” and adds, “As the economic recovery continues, there is hope that fleet sales will pick up later in the year. However, the shift away from sedans toward SUVs and light trucks appears to be irreversible for the near future.”

Cox Automotive senior economist Charlie Chesbrough reports, “An expected month-over-month uptick in the sales pace suggests the vehicle market is starting the year on solid ground even with so much uncertainty in the economy. Thin inventories remain a reality for many dealers and consumers, a result of COVID-19 production disruptions, although the worst inventory issues are in the rearview mirror. Other risks to auto sales include large waves of COVID-19 cases during the winter and a second dip in the economy.”

Looking over employment issues, Dr. Long reports, “As the recovery continues, the West Michigan Employment Index bounced up to +20 from December’s +11,” and adds,”At the state level, Michigan’s January 28th unemployment tabulation for December (the latest month available) reported that the seasonally adjusted, state-wide unemployment rate rose to 7.5-percent from 6.9- percent, largely because of the reimposed COVID-19 restrictions. Because of day care problems caused by school closings as well as ongoing concern about keeping safe from the virus, the worker absentee rate continues to distort normal operations for many firms.”

The recent rise in Long’s Lead Times Index continues to push industrial prices higher because of numerous spot shortages. He says that for January, the West Michigan Price Index rose to +59, up from +43, and adds, “Price increases in some of the major commodities like most grades of steel, aluminum, and plastic resins are starting to stifle profitability, especially when the cost of labor is continuing to rise at the same time for some of the firms in our survey panel.”

Turning his attention to future forecasting, Professor Long says that his Short-Term Business Outlook Index for January, which asks local firms about the business perception for the next three to six months, remained virtually unchanged at +17, down slightly from +19. His Long-Term Business Outlook Index, which queries the perception for the next three to five years, eased modestly to +36 from +41. Long contends, “Although business confidence is partially driven by the news cycle, the nagging disruptions in the supply chains worldwide are causing local business confidence to moderate as well.”

Summarizing the marketplace for January, Professor long says, “Because of the resurgence of COVID-19, bars, restaurants, churches and other gathering places have largely experienced a poor start to 2021. However, most industrial firms remained open and were able to take advantage of the demand that built up over many months of lock-down. The incoming Biden administration has issued many new directives that, so far, have not had any direct impact on the current pace of the recovery for auto parts producers. The same is true of the office furniture industry, which has plenty of problems of its own.” He goes on to suggest, “If the new stimulus package addresses the problems of the airline industry, it will be good for the long-term survival of local aerospace firms in West Michigan. Because of the disruptions brought on by the pandemic, at least some workers have been pushed out of the labor force and are no longer looking for regular employment.” Ironically, despite that, several firms are again struggling to find enough workers to fill their openings, and those recruiting professionals continue to complain that the education systems are not turning out enough people with the right compliment of skills to meet current hiring demands.

As is Dr. Long’s practice, he shares a number of verbatim anecdotal comments from survey participants in an anonymous fashion to give you a feel from the trenches. Here are some of those comments:

- “Business is picking up.”

- “Many steel items and corrugated box prices continue to rise. We are meeting our sales plan, but are having difficulty filling our open key positions through the hiring process.”

- “We are struggling to staff our production plant floor. We cannot get enough people to apply.”

- “Lead times are much longer now with the shortages our suppliers are experiencing. Sales are down because customers cannot get all the components they need.”

- “We are seeing a strong start to the year and hope the trend continues into Q3 and Q4.”

- “We are still short on production people.”

- “Orders are softening up some, but we are still doing fairly well, given the current economic environment.”

- “Covid-19 has increased our sales dramatically.”

- “We ended the year down 15-percent from year before, our worst year since 2008. The biggest customers are doing OK, but the smaller players are way down. That being said, all employees were maintained and we are still paying the bills.”

- “We see a slight improvement after a horrendous fourth quarter.”

- “As we come out of the pandemic somewhat, we believe we are returning to a more stable (if this can ever be true) situation. Price increases did not happen in 2020. We also see the labor market shortage forcing wage increases which must be recovered.”

- “It’s probably the most challenging past three months of my career trying to manage the ‘right’ stock and inventory. The past year has been a disaster. The outlook for the next 6 months does not look to be better even though business and sales dollars are good.”

- “We are busier, but can’t produce to schedule due to lack of employees.”

- “There’s not much changed from last month. Sales, inventory, labor are all steady.”

- “Our industry is waiting to see what the new President will do with the China tariffs. If they stay enforced, then work will go up for us. But if he removes them, we will be competing with China for prices, and we can never beat their prices.”

- “Labor. I am sure this is common, but we are struggling to adequately staff manufacturing jobs with qualified people.”

You can find Dr. Long’s full report by clicking this link: gr-2021-02