If you count yourself among those who feel cash-strapped and bearing an unusual burden when it comes to your rent or mortgage costs and other housing expenses, you are certainly not alone.

A new survey from an industry group called Construction Coverage, serving the needs of the construction industry, says that more than a quarter of Michigan households are “cost-burdened” by housing expenses. Michigan’s cost burdened run to 26.6-percent of the state’s households.

Construction Coverage says, “According to the most recent data from the U.S. Census Bureau, almost one-third of American households are considered cost-burdened, meaning they spend 30-percent or more of their income on housing costs.” They add, “While this figure has declined by almost 6-percentage points following the Great Recession, it is likely to increase again as the U.S. faces an unprecedented economic downturn due to the Coronavirus pandemic. Millions of Americans have experienced loss of work or other financial hardships due to the ongoing economic shutdown. Those households who already spend more than 30-percent of their income on housing are especially vulnerable.”

The new report points out that on the fortunate side, many mortgage lenders are offering options to defer mortgage payments, and the federal government is pausing foreclosures and evictions on mortgages backed by Fannie Mae and Freddie Mac or the Federal Housing Administration. Renters, on the other hand, face a more uncertain situation— as in most cities it will be up to individual landlords to work out payment options for renters unable to pay rent.

While nearly one-third of all households are cost-burdened, renters are more likely to be than homeowners. Nationally, over 46-percent of renter households are cost-burdened compared to just 22.3-percent of owner households. That holds true across all income groups with the exception of those households making $75,000 or more. Renters may be doubly hurt in the current economic crisis due to their increased likelihood of being cost-burdened and not having the same financial protections as homeowners.

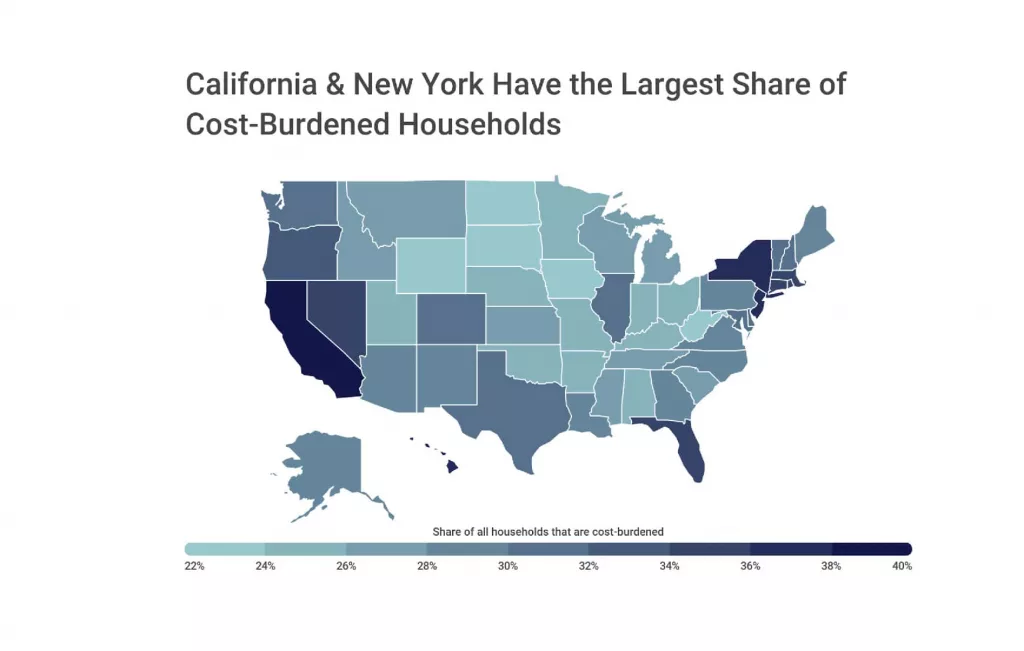

Due to differences in housing costs and job markets across the country, the numbers of cost-burdened households vary significantly across cities and states. At the state level, California and New York have the largest shares of cost-burdened households in the country, at 40.5 and 37.5-percent, respectively. North Dakota claims the lowest share of households that are cost-burdened, at 22-percent.

To determine the states with the most cost-burdened households, researchers at Construction Coverage, a review site for construction software and insurance, analyzed the latest data from the U.S. Census Bureau. The researchers ranked states according to the share of all households that are cost-burdened. Researchers also calculated the share of owner households that are cost-burdened, the share of renter households that are cost-burdened, median monthly housing costs, and median household income.

The analysis found that 26.6-percent of Michigan households are cost-burdened, compared to the national rate of 31-percent. Here is a summary of the data for Michigan:

- Share of all households that are cost-burdened: 26.6-percent

- Share of owner households that are cost-burdened: 19.3-percent

- Share of renter households that are cost-burdened: 44.7-percent

- Median monthly housing costs: $881

- Median household income: $56,697

For reference, here are the statistics for the entire United States:

- Share of all households that are cost-burdened: 31.0-percent

- Share of owner households that are cost-burdened: 22.3-percent

- Share of renter households that are cost-burdened: 46.1-percent

- Median monthly housing costs: $1,082

- Median household income: $61,937

For more information, a detailed methodology, and complete results for all states, you can find the original report on Construction Coverage’s website at the link below:

https://constructioncoverage.com/research/cities-with-the-most-cost-burdened-households

Construction Coverage was started by a small group of technology and finance experts with a desire to help businesses in the construction industry. Their guides, research, and reviews are created with the goal of helping the buyer find the right solution for their business.

They provide easy-to-read, trustworthy reviews of solutions for the construction industry, primarily software, financial products, and insurance, with the goal of helping buyers rapidly narrow down their options to the most likely fit. They also provide plenty of information to help the reader understand the market and the decision at a deeper level.

They also offer thoughtful analysis and data-driven research of industry trends, to help construction managers make wise business decisions.